where does credit score start canada

A credit score is a number on a scale of 300 to 900. In Canada scores range between 300 and 900 while in the US.

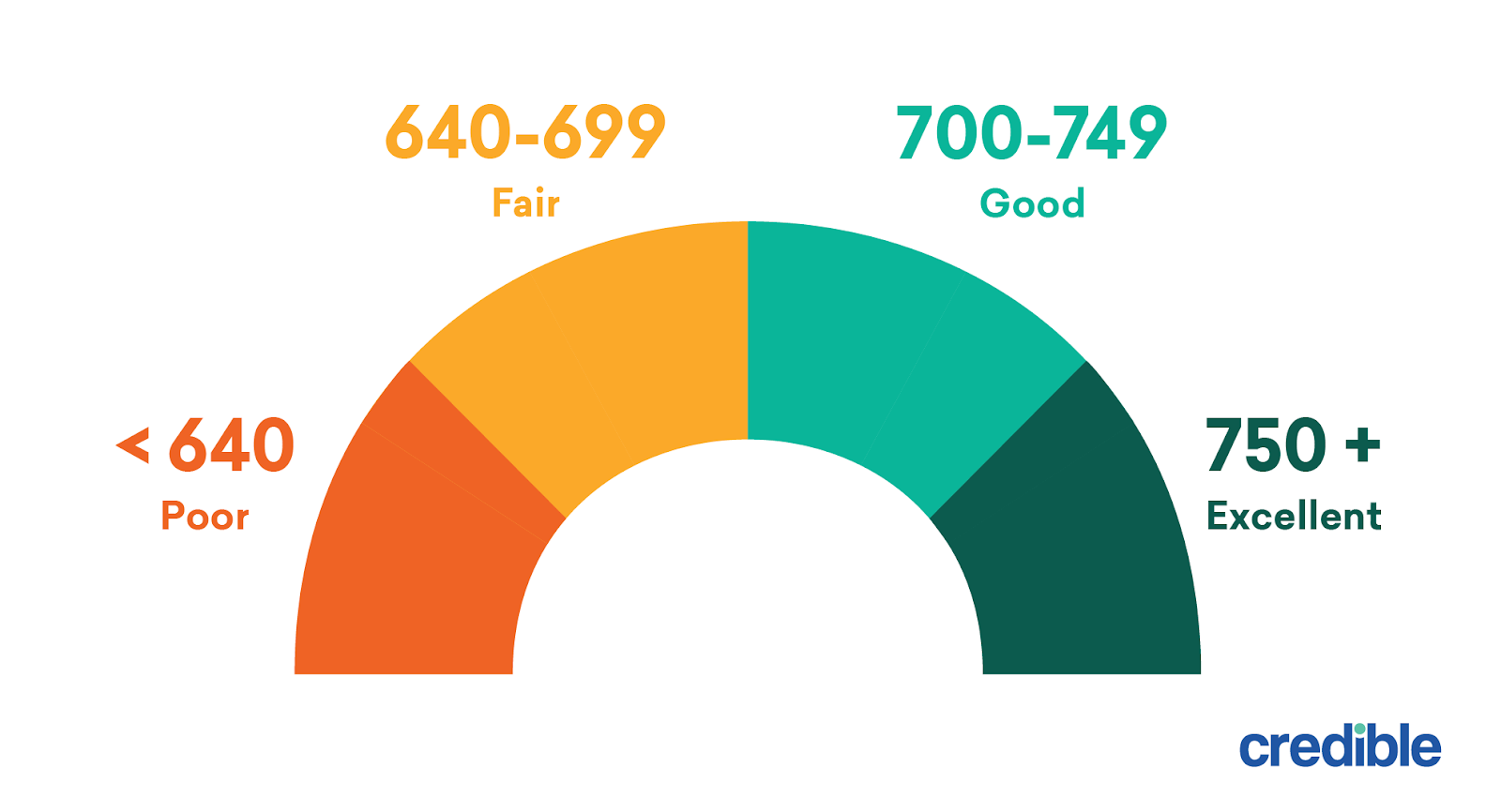

750 Credit Score Mortgage Rate What Kind Of Rates Can You Get Credible

First introduced in 1989 by Fair Isaac and Company as well as Fair Isaac Corporation today Fair Isaac Corporation is regarded as one of the most important technology companies.

. Obtaining a mortgage or a credit card involves calculating credit or loan risk using the standard risk profile. Instead it means that your credit score doesnt exist yet. When Did Credit Scores Start In Canada.

TransUnion says that 650 points constitutes the magic middle number a score of 750 or higher are more likely to qualify you for a loan while a score under 650 might make receiving a new credit more difficult. The answer may surprise you. We speculate this may be due to the fact that it takes time to build credit.

Most immigrants to Canada will go the same route. Banks credit unions and other financial institutions credit card companies car leasing companies retailers. If you do an online search for what is a good credit score in Canada youll probably notice that not every source uses the exact same numbers.

If youve never had credit activity a credit card or. Finding and fixing errors on your credit report and protecting yourself from fraud. As soon as you swipe your credit card for the first time your credit card provider utility companies and any other creditors will begin reporting your behaviour to the big credit bureaus.

Your Credit Score Doesnt Start at Zero. What Does Credit Score Start At In Canada. This is not the same as a poor or zero credit score.

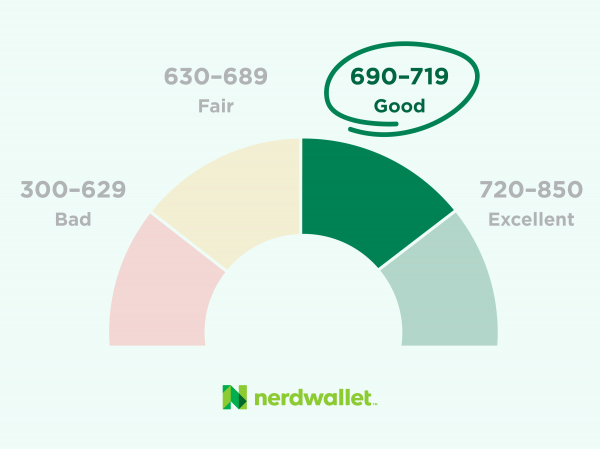

The higher the score the better you are at repaying your debts. Money that doesnt belong to you. In Canada though and for our purposes here a good credit score is anything between 660 and 724.

Accordance is also a score in Ontario known as Beacon. 1-877-713-3393 Quebec residents Confirm your identity by answering a series. The credit score range in Canada is between 300 and 900 with the higher the better.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada. ViDI Studio Shutterstock Most Canadians begin their credit history with their very first credit card which they can get on their own by the age of 18 or 19 depending on the age of majority in their region. Equifax and TransUnion are the two main credit bureaus in Canada.

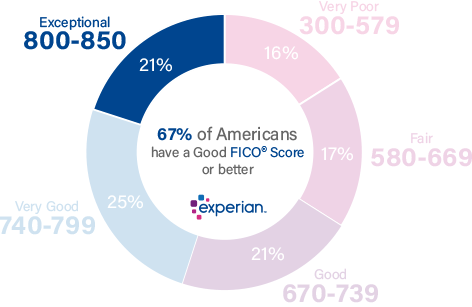

850 is the maximum score. Credit scores start at 300. Chances are good that your first credit score will land somewhere in the middle since you havent had time to do much harm or make much progress.

In Canada credit scores can be as high as 900 and as low as 300 but dont worry. On average Canadians within the youngest age bracket 18 25 have a credit score of 692 while the oldest 65 have a credit score of a little over 740. Fair Isaac Company the company that introduced it in 1989 later merged with the FICO Corporation.

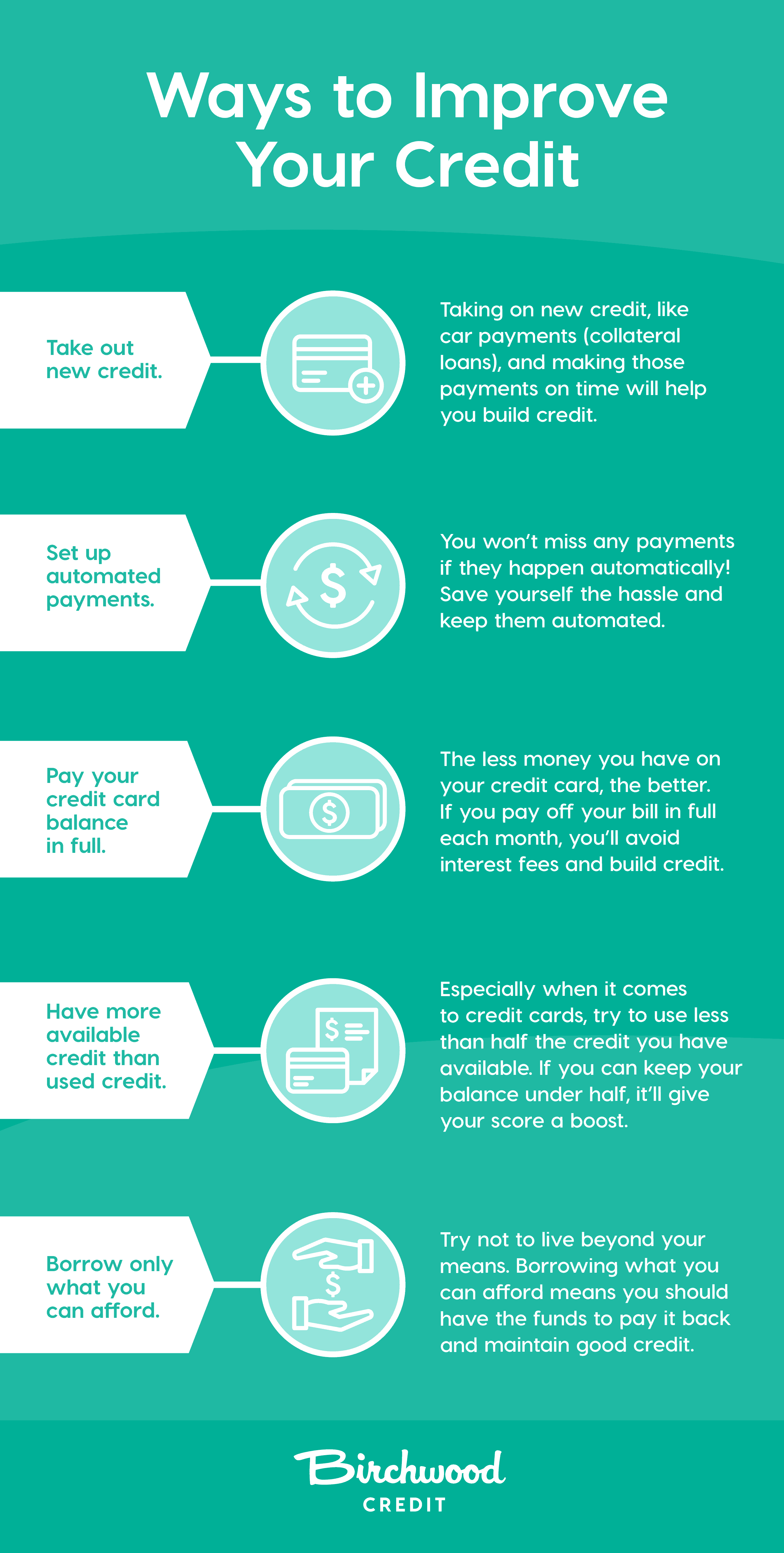

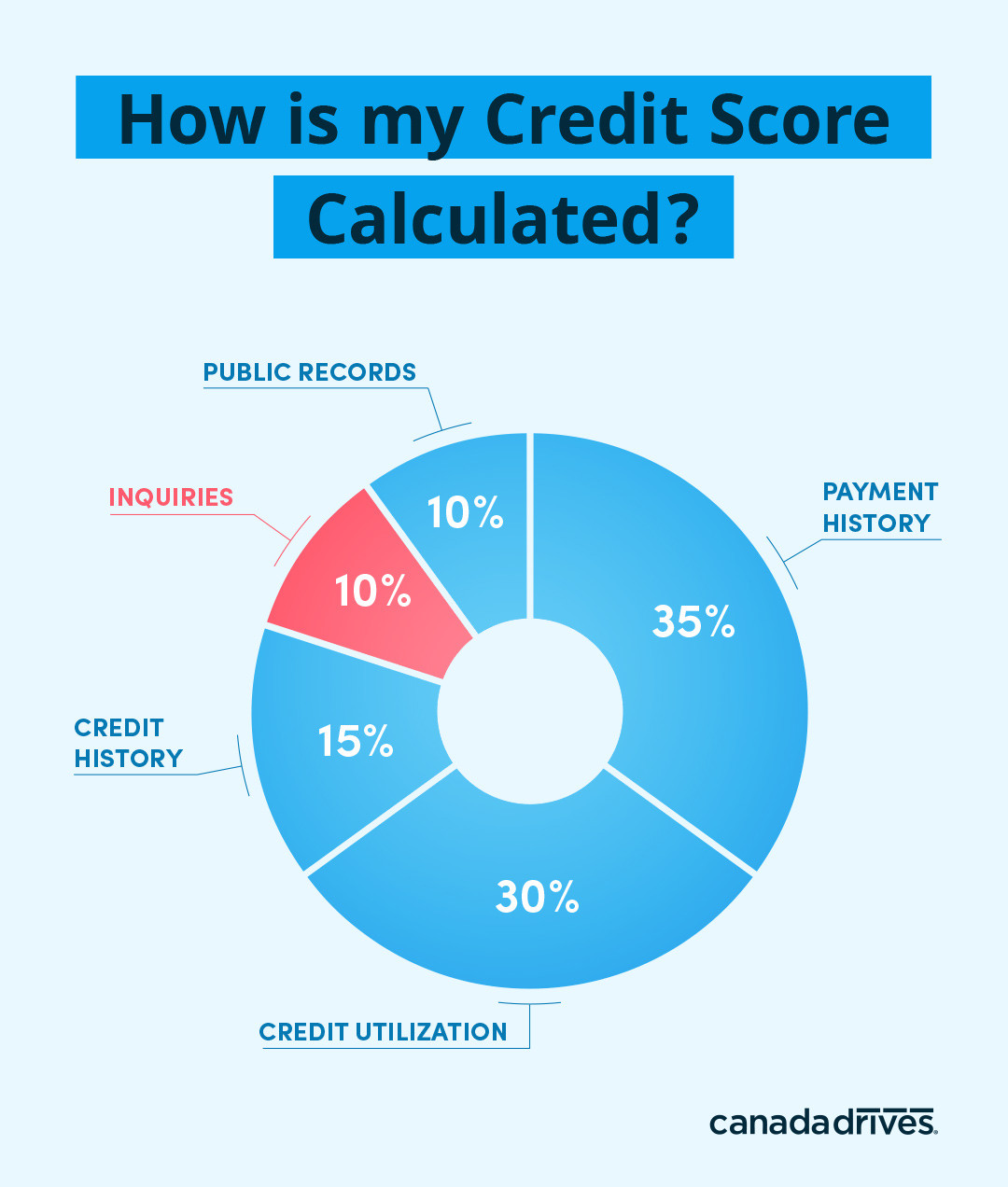

Your credit history begins when you open your first credit card and it will take about six months for the major credit bureaus to gather enough data to calculate your initial score. When Did Credit Scores Start In Canada. You are then given a credit score based on the following factors.

The best credit score in Canada is 1000 which indicates how much credit you have accumulated up to this point. As soon as you establish credit your first credit score may range from 500 well in the 700s depending on how well you do as a borrower. In Canada your credit score refers to a three-digit number usually between 300 and 900 that indicates your creditworthiness In other words its a kind of report card on how good you are at managing debt and financial responsibility.

The first step in establishing and building credit is understanding what comprises your credit score. You wont start with the lowest score youll start with no score at all. More recent payment history has a greater impact on your score and.

In Canada you will get credit scores as high as 900 points as a simple starting point. Their job is to collect store and share information about how you use your credit. They use this information to calculate your credit score which they store and may share with.

When you first arrive in Canada you start with no credit score. Since six months isnt much time to make a dent in your credit your initial score will likely fall somewhere in the middle range. Similarly a foreclosure means a credit score falls 140-160 points if your original credit score was 780 but falls only 85-105 if your original credit score was 680.

Its d none of the above. Checking for errors on your credit report. In TransUnions view a score that is above 650 will likely allow you to receive a standard mortgage loan while a score that is below 650 is likely to block you from receiving new credit insurance.

These private companies only collect information about how you use credit. Who creates your credit report and credit score There are two main credit bureaus in Canada. Payment History Debt Burden Length of History Types of Credit and Recent Searches.

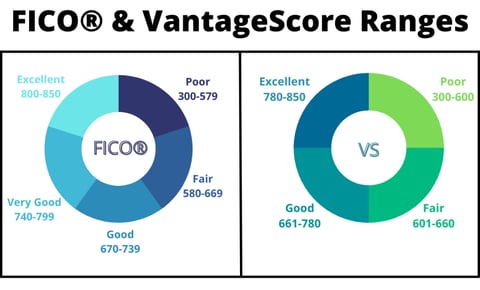

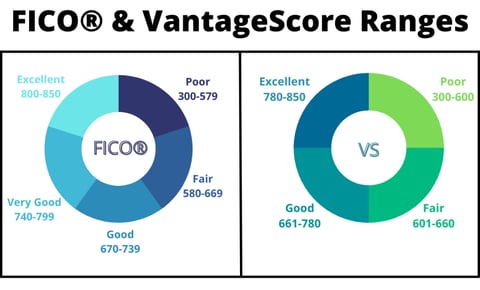

In both countries the credit scores are calculated off of five factors. What credit score do newcomers in Canada start with. Starting with no credit score doesnt mean your score is zero.

Where does my score come from. How long credit bureaus can keep information that may affect your credit score. Data also shows that as age increases so does the average credit score number.

The lower the score the. This will change once you get credit from a financial institution and start using and repaying it. 1-800-663-9980 except Quebec Tel.

Equifax TransUnion These are private companies that collect store and share information about how you use credit. It tells potential lenders how well you manage debt and credit. Some say that the Good range starts at 660 some at 650 and some even as high as 720.

Call the credit bureau and follow the instructions. In reality everyone starts with no credit score at all. There are two main credit bureaus in Canada Equifax and TransUnion.

Do you begin at a the highest possible credit score b the lowest or c somewhere in between. Where does my score come from. ViDI Studio Shutterstock For the majority of Canadians it starts with credit cards.

Canada and the United States work on a similar credit scoring system issuing three-digit scores. How long information stays on your credit report. After around six months of using your first credit card the credit bureaus will have enough data to calculate your score.

How To Improve Your Credit Score Lendingtree

Everything You Need To Know About Credit Scores Canada Drives

Fico Credit Score Range Fico Credit Score Credit Score Range Credit Score

800 Credit Score Is It Good Or Bad

8 Easy Ways To Increase Your Credit Score Fast In Canada In 2022 Improve Credit Score Improve Credit Paying Off Credit Cards

How To Fix Your Credit Score Yourself Credit Score Fix Your Credit Credit Repair

Is Transunion Credit Score Accurate Fico Vs Vantagescore Badcredit Org

In Canada Credit Scores Range From 300 To 900 Where Your Number Falls In This Range Will Determine Whether Credit Score Range Credit Score Low Interest Rate

A Beginner S Guide To Understanding And Improving Your Credit Score Fix Your Credit Improve Your Credit Score Credit Repair

What S Considered A Good Credit Score Transunion

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

Credit Score Range What Is The Credit Score Range In Canada

:max_bytes(150000):strip_icc()/7-things-you-didnt-know-affect-your-credit-score.aspx-ADD-V2-f87cdc4ddf2c4c7a93d078f56015ed55.jpg)

7 Things You Didn T Know Affect Your Credit Score

600 Credit Score Is It Good Or Bad

No Credit Score Doesn T Mean A Zero Credit Score Nerdwallet

Understanding Your Credit Score Is The Foundation To Your Financial Future Knowledge Is Credit Mortgageb Credit Repair Fix Your Credit Credit Restoration

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

Do Credit Checks Hurt Your Credit Score

You Don T Need The Highest Credit Score To Qualify For The Best Interest Rates But Your Score Will N Credit Card Pictures Credit Card Infographic Credit Score